“We have to understand that anything in the past takes you out of the present moment. Anything in the future takes you out of the present moment.”

Zen Master Daigneault

To readers who are visiting this blog for the first time my posts on Random Thoughts About Retirement and Unretirement are written by an Old Guy who is old enough to be retired but isn’t retired and is still working. I had another birthday and the older I get the more I think about retirement. Back in 2023 I was thinking about what retirement for me would look like (see More Random Thoughts on Retirement – June 2023). But decisions such as this take serious thought and consideration. At first I thought I wanted to retire to a quiet life of blogging and writing my Future Best Seller titled The Man Who Had No Hobbies. After much thought I decided to add a short term goal to my retirement plan. My new short term goal is to avoid unretirement.

My RSS feed feeds me headlines on unretirement.

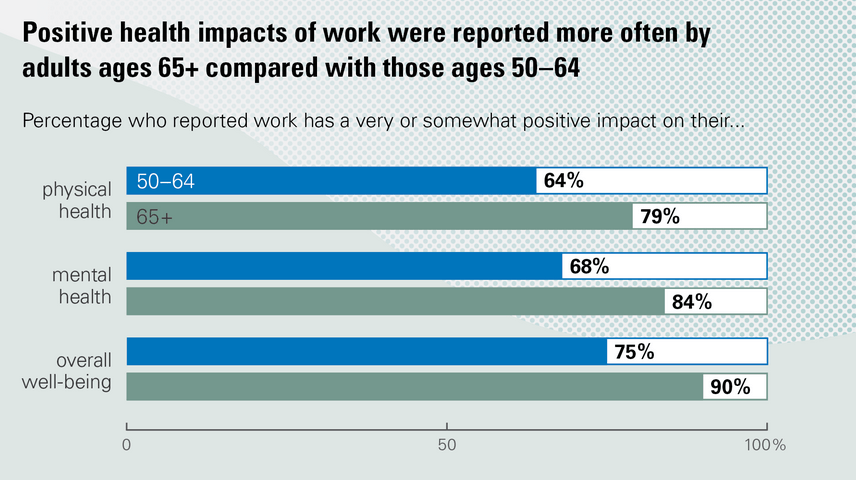

According to a new report from T. Rowe Price around 7% of retirees are looking for work in retirement, while 20% say they’re already working part time or full time…The two main reasons for coming back into the workforce are a tale of opposites. While 45% chose to work for social and emotional benefits… a slightly larger percentage — 48% — felt they needed to work for financial reasons.

Unretiring: More retirees are going back to work because they want to — or need to — https://finance.yahoo.com/news/unretiring-more-retirees-are-going-back-to-work-because-they-want-to–or-need-to-123203300.html

And this.

Once an eagerly awaited milestone, retirement is currently undergoing a transformative reevaluation. Traditionally seen as a well-deserved period of rest and relaxation, the dream of early retirement is now being challenged by a new perspective – that of embracing lifelong work. This paradigm shift reflects the changing nature of work, increased life expectancy, and the desire for personal fulfillment.

Rethinking Retirement: The Case for Embracing Lifelong Work — https://due.com/rethinking-retirement-the-case-for-embracing-lifelong-work/

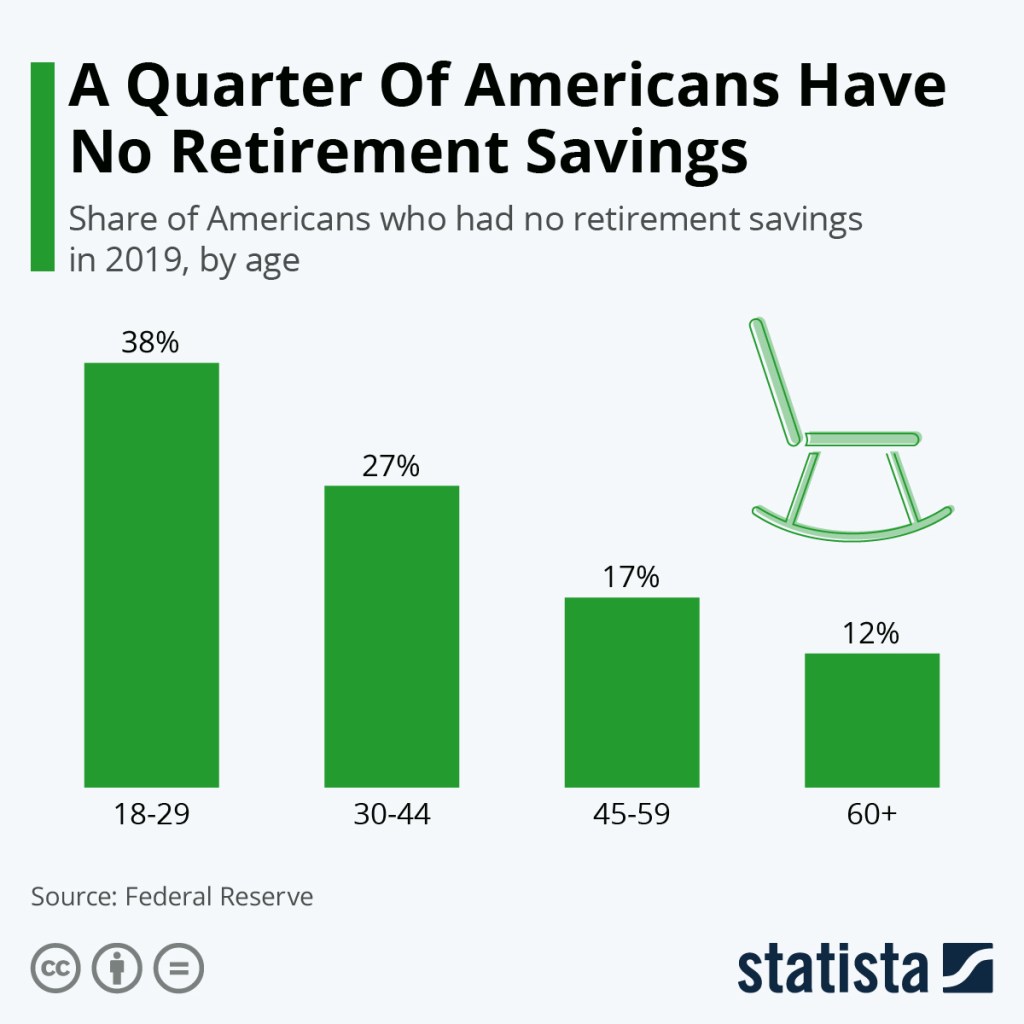

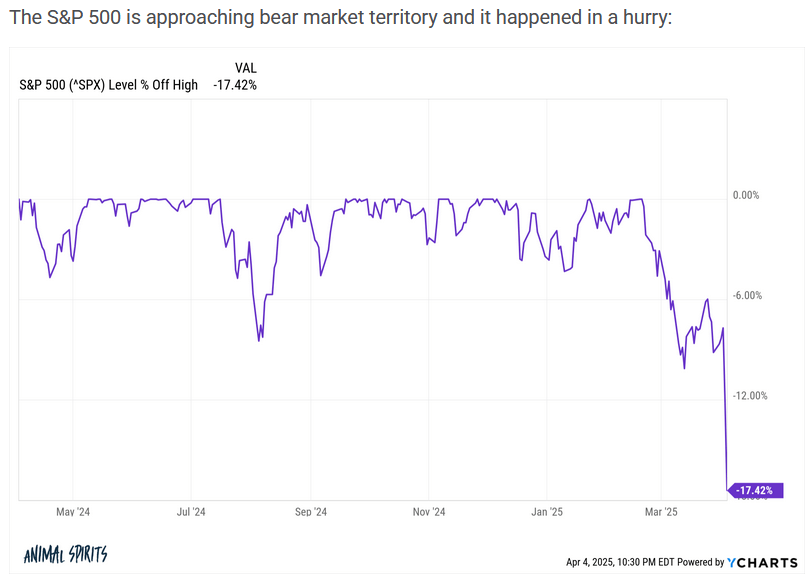

The reality is many won’t have a choice. The following chart illustrates retirement savings as of 2019.

Americans are having trouble financially preparing themselves for life after work. A recent Federal Reserve report found that nearly a quarter of U.S. adults have absolutely no retirement savings or pension. Even though the level of preparation increases as people get older, concern about inadequate savings is still readily apparent across all age groups, even older people in their 60s.

A Quarter Of Americans Have No Retirement Savings — https://www.statista.com/chart/18246/share-of-americans-who-have-no-retirement-savings/

OOPS. I’m glad I didn’t click the Publish button. The savings situation appears to be worse than I thought. The study below was an analysis of data from 2010!

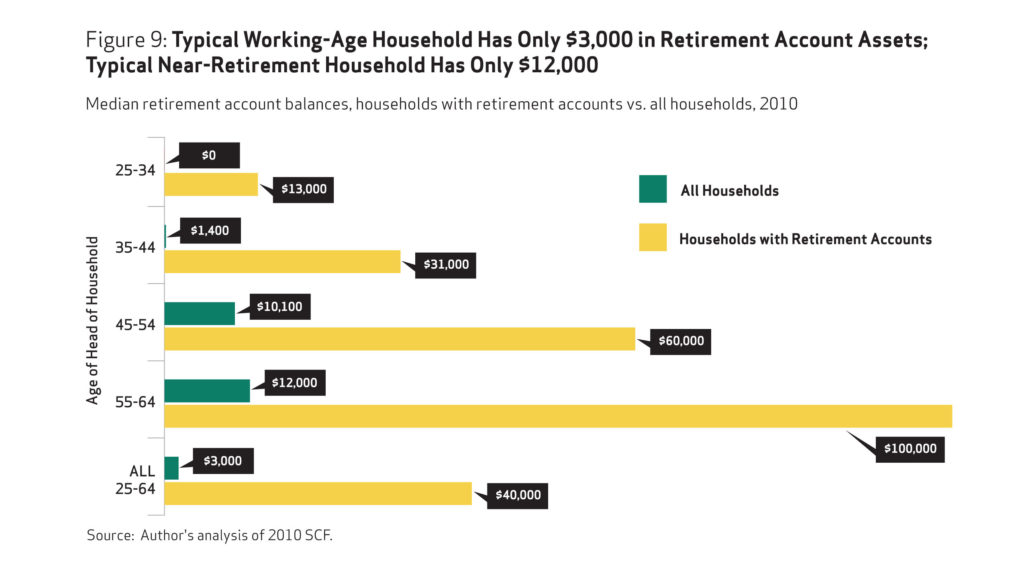

The study broadly examines how American households are faring in relation to retirement savings targets recommended by some financial services firms. It uses the Federal Reserve’s Survey of Consumer Finances to analyze retirement plan participation, savings, and overall assets of all U.S. households age 25 to 64, not just those with retirement account assets. This is important because some 45 percent, or 38 million working-age households, do not have any retirement account assets.

The average working household has virtually no retirement savings. When all households are included— not just households with retirement accounts—the median retirement account balance is $3,000 for all working-age households and $12,000 for near-retirement households. Two-thirds of working households age 55-64 with at least one earner have retirement savings less than one times their annual income, which is far below what they will need to maintain their standard of living in retirement.

The findings confirm that the American Dream of retiring comfortably after a lifetime of work will be impossible for many. Based on 401(k)–type account and IRA balances alone, some 92 percent of working households do not meet conservative retirement savings targets for their age and income. Even when counting their entire net worth, 65 percent still fall short.

The Retirement Savings Crisis: Is It Worse Than We Think? — https://www.nirsonline.org/reports/the-retirement-savings-crisis-is-it-worse-than-we-think/

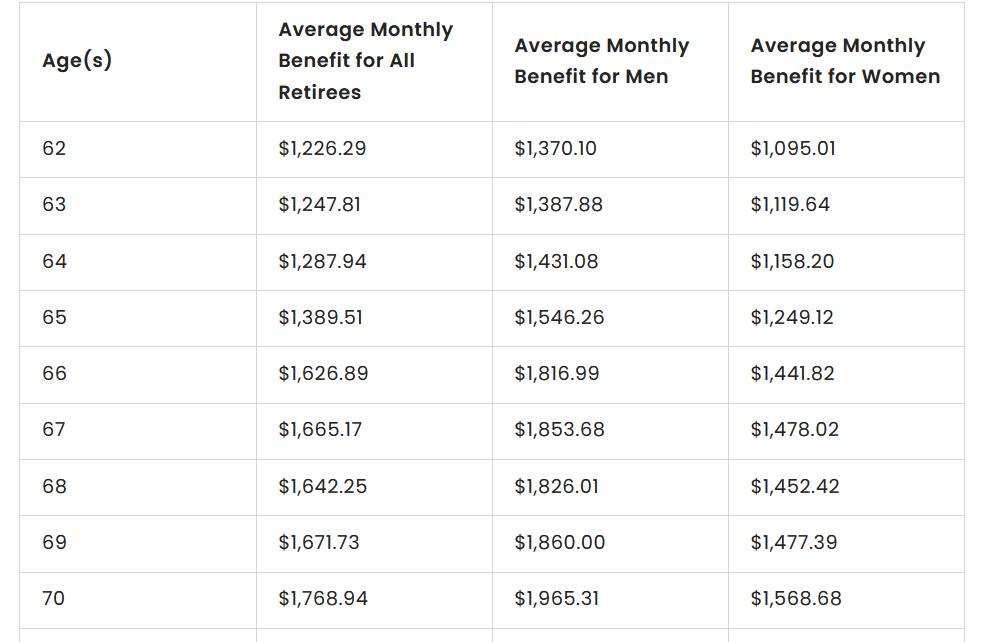

So how will you afford retirement without any savings? Don’t look to Social Security. Here’s some numbers on average Social Security payments. The full chart at the source website goes up to age 100.

As of December 31, 2021, the average Social Security payment for all retirees was $1,658.03 a month, according to the Social Security Administration’s Annual Statistical Supplement for 2022. For men, the overall average was $1,838.08. For women, the average was $1,483.75 — a difference of $354.33 per month.

Here’s the Average Social Security Check for Men vs. Women — https://www.gobankingrates.com/retirement/social-security/average-social-security-check-men-women/

I’ve previously advised everyone to Save as Much as You Can Because Whatever You Manage to Save Will Never Be Enough – Random Thoughts on Retirement. Now here’s my second piece of sage advice: keep working so you don’t have to unretire.

Whether people unretire or simply stay in the workforce longer, some of the largest financial benefits of additional years of work are delaying retirement account withdrawals and delaying claiming Social Security benefits. These actions essentially shorten the amount of time your assets will need to support you in retirement. Even a few additional years of income have a positive effect on the probability that you won’t outlive your funds.

“Unretiring”: Why Recent Retirees Want to Go Back to Work — https://www.troweprice.com/personal-investing/resources/insights/unretiring-why-recent-retirees-want-to-go-back-to-work.html

Whew. Long post. Longer than I anticipated. If you made it this far, congratulations!

Double OOPS. Hit the publish button too soon. Postscript.

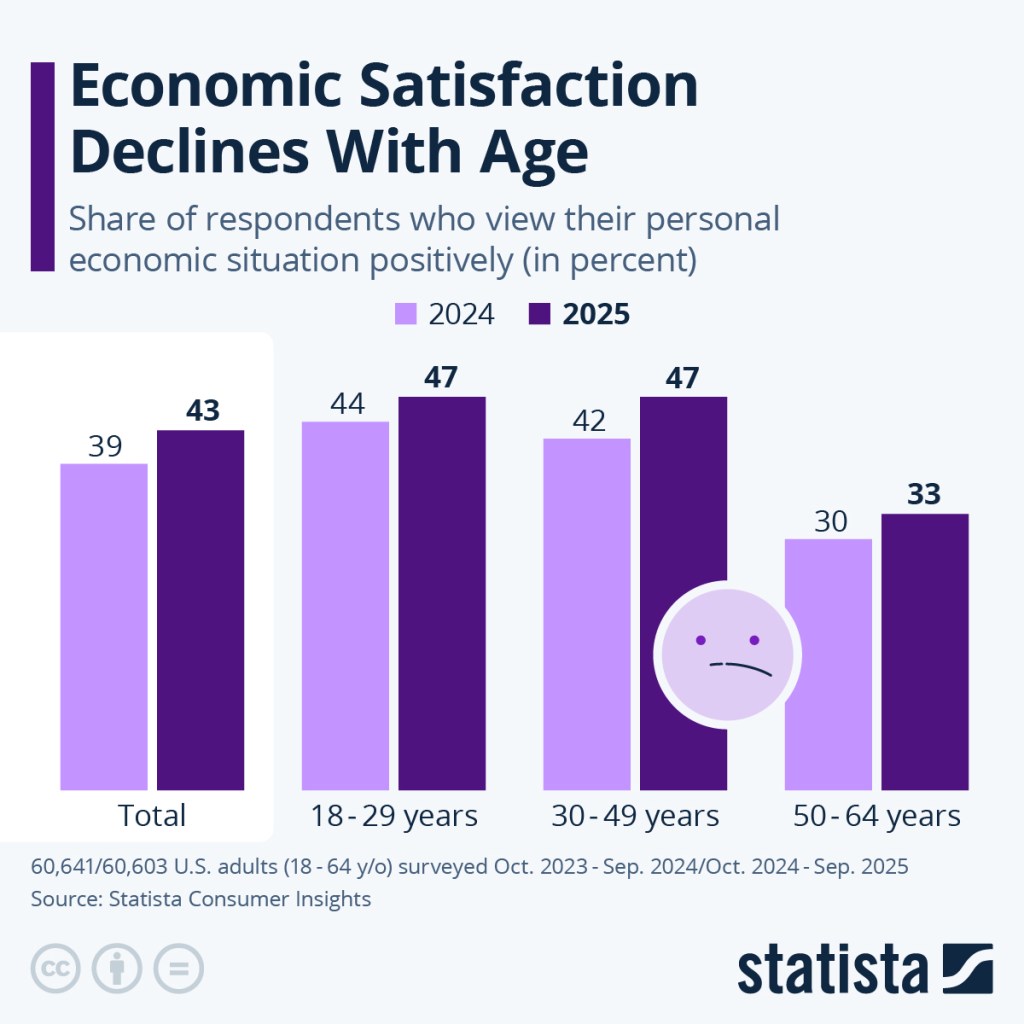

Economic Satisfaction Declines With Age – https://www.statista.com/chart/35656/us-respondents-who-view-their-financial-situation-positively/

Note the survey respondents’ age stops at 64.

You must be logged in to post a comment.