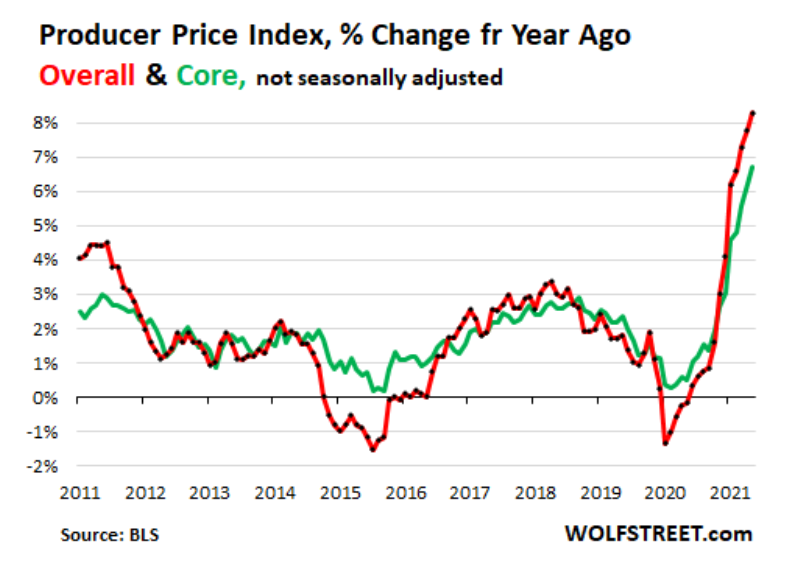

Prices in the three production stages that are the furthest up the pipeline (Stages 1-3, red, green, gray) have all jumped by over 20% year-over-year. Prices at production stage 4 (black), up 12.1% year-over-year, are inputs for final demand prices, which are inputs for consumer prices.

Final demand prices are what consumer prices will encounter pretty soon in their consumer prices. Stage 4 intermediate demand prices will follow. And prices in productions stages 1-3 are further behind, but they’re true whoppers, and they will provide massive pressures on consumer prices for months to come:

Up the Price Pipeline, Inflation Rages at 20% — https://wolfstreet.com/2021/09/10/up-the-price-pipeline-inflation-rages-at-20/#comments

Prior to the 1950’s, there was no such thing as retirement, as the term is used today. A 1950 poll showed that most workers aspired to work for as long as possible. Quitting was for the disabled. Also, remember that in 1935 when the government was determining the appropriate retirement age for social security (65) the average adult male died at age 63.

The Baby Boom generation is also living longer than the generation before it. Chances are a married couple age 65 will have one spouse live into his or her early nineties. That is nearly 30 years of living off of one’s savings and Social Security if one retires at age 65. The math does not work for this many people. For so many to have golden years, there needs to be gold (money) to support them.

Trust Company Oklahoma May 2016 The Retirement Myth — https://www.trustok.com/our-latest-quarterly-newsletter/

Thinking about retirement? I’ve been thinking about retirement for quite some time and the thought of not working doesn’t appeal to me. There will come a time when the 40+ hour workweek will be no longer doable. But for now that time is far off in the future. The math in retirement will not work for the majority. I see inflation all around and my planned retirement income streams and savings will not last as long as hoped if everything costs more. Retirement math now is simple. If you can, work longer and save more.

You must be logged in to post a comment.