Again, you can’t connect the dots looking forward; you can only connect them looking backward. So you have to trust that the dots will somehow connect in your future. You have to trust in something — your gut, destiny, life, karma, whatever. This approach has never let me down, and it has made all the difference in my life.

Steve Jobs

Save as Much as You Can Because Whatever You Manage to Save Will Never Be Enough – Random Thoughts on Retirement was the post that started the entire series of periodic Random Thoughts on Retirement. In More Random Thoughts on Retirement – Memorial Day 2024 I wrote about staying healthy as my primary goal in retirement.

Another Big Dot

Sometimes things in life work out as planned. Sometimes they don’t. This time the plan is going as planned. At my annual wellness check up everything turned out fine except for my blood pressure. The two readings taken showed an elevated systolic and per Doctor’s orders I had to buy a BP machine which set me back $36 plus tax. I was instructed to keep a log for two weeks. For grins, I checked my online account to see what Dr. Lewis wrote for the office visit notes. No mention whatsoever regarding my BP readings. Probably because both of us felt this wasn’t a huge problem. The Boss started showing some concern and I had to report my pressures to her every day. Again I felt this wasn’t a worrisome medical issue. Besides if the diagnosis was hypertension I was looking at daily Lisinopril 10 mg, no big deal.

After two weeks I sent Dr. Lewis my log. She replied later that day.

Thank you for diligently keeping track of your blood pressure readings. I see that your readings have been fairly consistent. Yes you can stop watching it. If you feel fatigued or headaches please recheck it.

Sincerely,

KL

I survived another annual wellness check. The Road to 70 is still pretty smooth. But the ride is not as smooth for others.

A CivicScience survey of nearly 3,000 respondents conducted between March and May 2024 reported 61% of those aged 55 and over say they won’t be able to retire by 65, and 53% will need to keep working even when they do retire. Boomers and Beyond: 5 Ways To Make Extra Money if You Retire in Your 70s – https://www.gobankingrates.com/retirement/planning/boomers-ways-make-extra-money-retire-70s/.

I admit to falling for the clickbait. Of course I wanted to know about 5 ways to make extra money if I retire in my 70’s. And I’m a Boomer. So I read the article. Here are the 5 ways to make extra money:

- Add Money to a High-Yield Savings Account

- Buy Dividend Stocks

- Rent Out Unused Space in Your Home

- Become a Dog Walker

- Become a Ride-Share Driver

What is the average monthly benefit for a retired worker? The estimated average monthly Social Security retirement benefit for January 2024 is $1,907. https://faq.ssa.gov/en-us/Topic/article/KA-01903

Hmm…

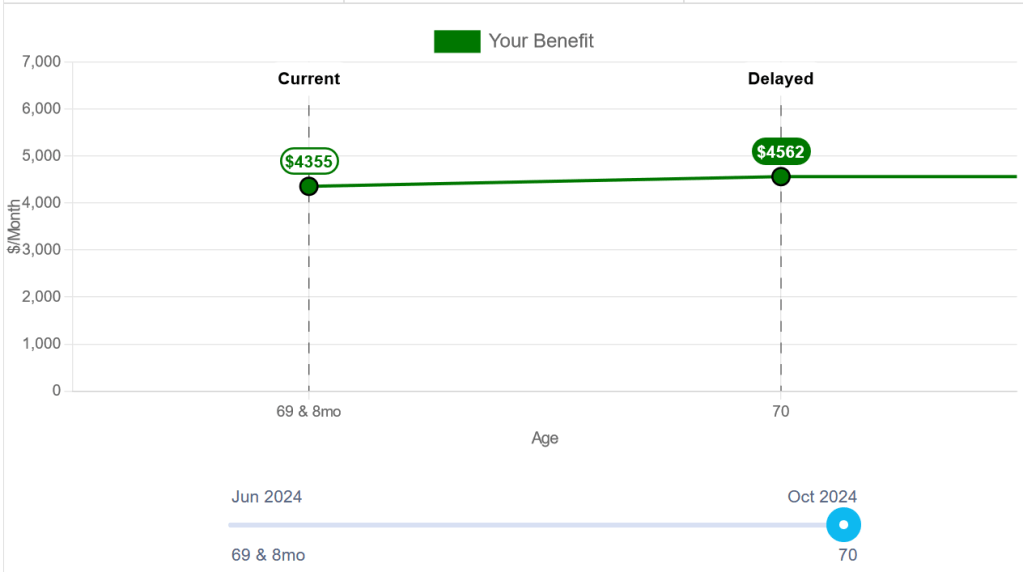

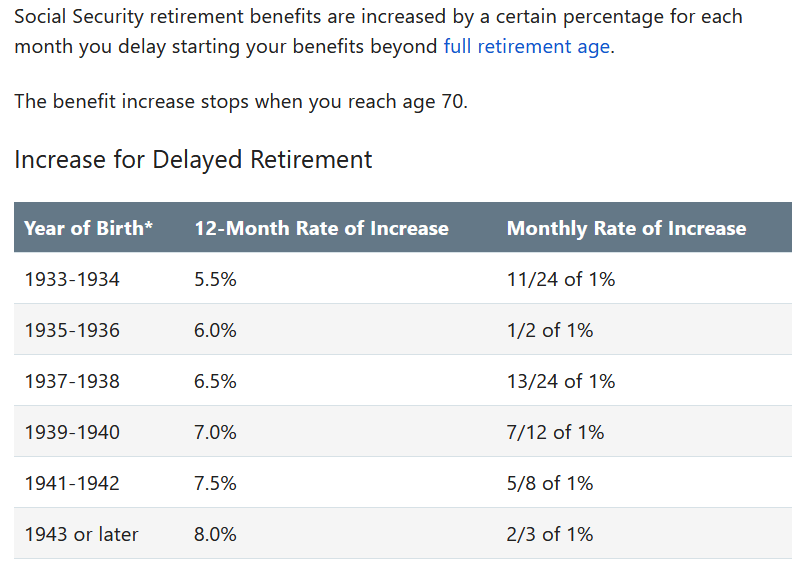

I wrote back in May that my focus was simple. All I had to do was stay healthy and stay connected with an employer willing to keep an Old Guy with a particular set of skills on the payroll. More Random Thoughts on Retirement – The Dot Project May 2024. At this point I hope to become a dog walker only if I want to, not if I have to. Prioritize your health. Save as much as you can. Plan on living AND working longer. Defer collecting Social Security retirement until you turn 70 (if you can). Read my other blog https://garyskitchen.net/. Tell your friends and family you found this blog written by an Old Guy on what it takes to become an Old Guy. They’ll love you for this.

You must be logged in to post a comment.