Keep moving people. Nothing to see here.

Intuit to lay off 1,800 employees, labels 1,050 as ‘underperformers’

YIKES.

Keep moving people. Nothing to see here.

Intuit to lay off 1,800 employees, labels 1,050 as ‘underperformers’

YIKES.

After the collapse of a Surfside Building on June 24, 2021 that killed 98 people, the state passed a structural safety law that is now biting owners. Not only are insurance rates soaring, but owners are hit with huge special assessments topping $100,000. Florida Condo Owners Dump Units Over Six-Figure Special Assessments — https://mishtalk.com/economics/florida-condo-owners-dump-units-over-six-figure-special-assessments/

Ouch.

One BR one bath 384 square feet. Sale pending is contingent so you can still make an offer. Here’s the listing: https://www.realtor.com/realestateandhomes-detail/10036-Carmen-Rd_Cupertino_CA_95014_M19549-12789

A very astute reader asked a very simple question: Why is this scary? So I went back and looked at my post. I thought I had completed the post but obviously not. The chart lacked context. So here’s the rest of the post I thought I posted. Welcome to my Senior Moment.

The relatively high labor force participation of Boomers may be beneficial both to them and the wider economy. Some retirement experts emphasize working longer as the key to a secure retirement, in part because the generosity of monthly Social Security benefits increases with each year claiming is postponed. For the economy as a whole, economic growth in part depends on labor force growth, and the Boomers staying in the work force bolsters the latter.

Baby Boomers are staying in the labor force at rates not seen in generations for people their age — https://www.pewresearch.org/short-reads/2019/07/24/baby-boomers-us-labor-force/

What I forgot to include in the post now follows.

After finishing and posting Even More Random Thoughts on Retirement – November 2023 something kept bugging me. So I thought about this for a while and uncovered what was bugging me. The following quote bugged me:

To ease the anxiety of retirement, consider delaying Social Security to get a larger monthly check and perhaps also purchasing immediate fixed annuities. I plan to do both.

What We Lose — https://humbledollar.com/2023/08/what-we-lose

Specifically the part of the quote in bold bugged me. I thought to myself, nice plan. But how many people can afford to buy an immediate fixed annuity? I can’t. How many people actually defer Social Security until age 70 to maximize their monthly payments?

Well, get ready for the ugly. It’s Scary Chart time.

Answer: 4%

Why just 4%?

Answer: 97% of people who retired sooner than planned did so due to health and employment issues.

Source: https://www.transamericacenter.org/retirement-research/23rd-annual-retirement-survey

Some retirees get fabulous bull markets right when they leave the working world while some retire into the teeth of a bear market.

How The Market Shapes Your Portfolio — https://awealthofcommonsense.com/2023/11/how-your-market-shapes-your-portfolio/

And some retirees will leave the working world straight into a world of high inflation.

Just beyond the guests and beyond the hornbeam trees where I’ve strung fairy lights for the party, I think I can see my future. The grind of work is finally over, my retirement dream cued up. April in Paris! Reading by the sea! Spanish lessons in Antigua so I can better speak to my grandson. I’ll be playing with him, too, in the open-ended days my children rarely knew with me. I’m not saying I deserve a life of ease. But I worked hard to earn my retirement, dropping giant chunks of my salary into company and government pension plans throughout those forty years. It’s time for the famous social contract to hold up its end of the bargain and take care of me, the way it did my father before me, to deliver on the idea that retirement is my right after a life of work and the promise that I will have the time and means to enjoy it.

Except none of that happened. The year since my retirement party has not been a dreamy passage to a welcoming future but a nerve-shattering trip into the unknown. My debt is swelling like a broken ankle; my hard-won savings may or may not be sucked into the vortex of an international market collapse. Can I keep my house? Who knows? The macro-economy is messing with my micro-economy. The future keeps shape-shifting. And none of the careful planning I put into my retirement is going to change that.

The End of Retirement — https://thewalrus.ca/the-end-of-retirement/

So beware of statistics. The reason why more Baby Boomers are working is because they have to.

Thank you Ol Red Hair.

Source: https://www.statista.com/chart/31306/countries-with-the-highest-annual-increases-in-consumer-prices/

I suppose this should make us feel better about higher prices in the US.

More good news – lithium is cheap again.

Lithium “Shortage” Bubble Implodes (Again), Price Collapsed 77% in a Year, as Demand and Production Both Surged – https://wolfstreet.com/2023/11/23/lithium-shortage-bubble-implodes-once-again-as-demand-and-production-both-surged/

Now all we need to do is find people who want and can afford to buy an EV.

Last month, Ford had laid off some workers building the F-150 Lightning electric pickup truck. Competitor General Motors also said it was postponing adding more production capacity for its electric Chevrolet Silverado EV citing slow-growing demand.

Ford battery plant is back on track but scaled down — https://www.cnn.com/2023/11/21/business/ford-battery-plant-downscaled/index.html

Average new electric vehicle prices are actually down by more than $14,000 compared with 2022, settling at around $50,683 on average, thanks to a combination of increased supply, the arrival of more affordable models and trim levels and aggressive price cuts by Tesla, the largest EV manufacturer in the US.

Cheapest Electric Cars for 2023 — https://www.cnet.com/roadshow/news/the-most-affordable-electric-cars-for-2023/

There just aren’t enough billionaires…

Manhattan’s Trophy Apartments Are Gathering Dust — https://www.curbed.com/2023/11/luxury-central-park-billionaires-row-hudson-yards-weak-sales.html

Close to 40% of all mortgages are paid off in this country. That’s mostly baby boomers.

That generation has the ability to sell their homes that are up like 500%, ignore 7% mortgages and buy in cash when they relocate for retirement.

I guess that makes sense but I would blame the unhealthy market on so many other factors before ever getting to the boomers.

Here’s my list in no particular order: The Fed, HGTV, the pandemic, remote work, the government (for not incentivizing the building of more homes), the Great Financial Crisis (totally screwed up the homebuilders), NIMBYs and Taylor Swift (her tickets are so expensive no one can afford a house).

If we want to fix the housing market, we have to build more houses.

It’s as simple as that.

6 Questions I’m Pondering At the Moment – https://awealthofcommonsense.com/2023/09/6-questions-im-pondering-at-the-moment/

Agree.

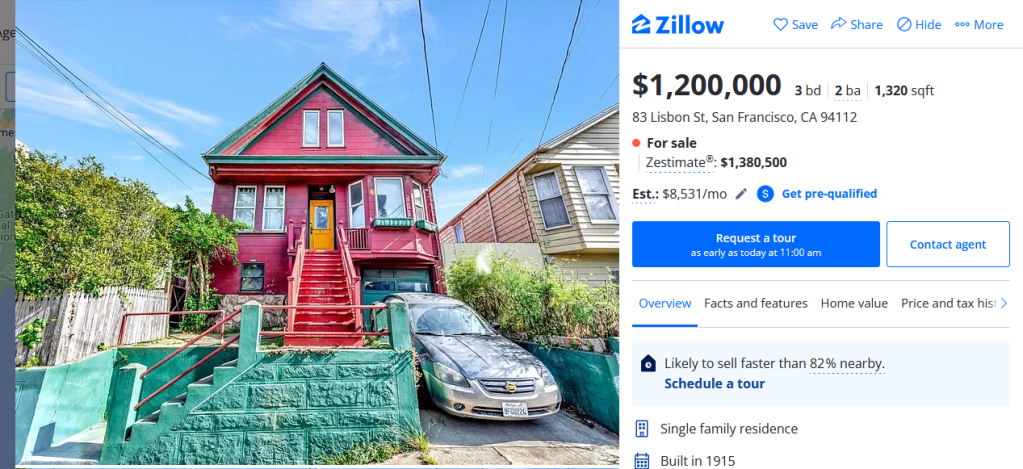

So that drywall mass produced home that sells for $1 million just went up from $4,519 a month to $7,016! That is a 55% increase in less than one-year. So we now have realtors struggling since they make money on high sales volume. You have commercial real estate getting absolutely smashed. Banks are in a tough spots since they made bets on a low interest rate environment. But now, that same home will cost you $2,497 more per month with no measurable increase in underlying value. The house does not have a built in chef, or unlimited childcare, or a Tesla that comes fully charged every day with no cost to you.

The Stalemate of the Century: Housing Facing an Existential Moment — http://www.doctorhousingbubble.com/the-stalemate-of-the-century-housing-facing-an-existential-moment/

Scary charts as promised from the same article:

Oklahoma.

Or California.

Source: https://www.statista.com/chart/31034/change-in-behavior-in-response-to-inflation/

One of the most important parts of exercise programming, no matter who I am working with, is proper resistance training to build muscle strength. Some amount of age-related loss of muscle function is normal and inevitable. But by incorporating resistance training that is appropriate and safe at any ability level, you can slow down the rate of decline and even prevent some loss of muscle function.

The medical term for a condition that involves age-related loss of muscle function and mass is sarcopenia. Sarcopenia can begin as early as age 40, but it tends to be more common in adults age 60 and older. Sarcopenia is associated with a number of health issues such as increased risk of falling, cardiovascular disease and metabolic disease, among others.

In one of our team’s previous studies, we saw that otherwise healthy individuals with sarcopenia had issues delivering vital nutrients to muscle. This could lead to greater likelihood of various diseases, such as Type 2 diabetes, and slow down recovery from exercise.

Recent estimates suggest that sarcopenia affects 10% to 16% of the elderly population worldwide. But even if a person doesn’t have clinically diagnosed sarcopenia, they may still have some of the underlying symptoms that, if not dealt with, could lead to sarcopenia.

Steep physical decline with age is not inevitable – here’s how strength training can change the trajectory —https://theconversation.com/steep-physical-decline-with-age-is-not-inevitable-heres-how-strength-training-can-change-the-trajectory-213131

Reducing overall calorie intake may rejuvenate your muscles and activate biological pathways important for good health, according to researchers. Decreasing calories without depriving the body of essential vitamins and minerals, known as calorie restriction, has long been known to delay the progression of age-related diseases in animal models. This new study suggests the same biological mechanisms may also apply to humans.

NIH/National Institute on Aging. “Calorie restriction in humans builds strong muscle and stimulates healthy aging genes.” ScienceDaily. ScienceDaily, 13 October 2023. https://www.sciencedaily.com/releases/2023/10/231013150733.htm

When I said random thoughts I meant it.

Source: https://theirrelevantinvestor.com/2023/08/23/the-great-and-awful-thing-about-these-interest-rates/ Original sources are credited in the charts.

Yikes!

You must be logged in to post a comment.