Americans today are lacking crucial savings needed for managing short-term emergencies and building long-term wealth. According to a rolling representative online survey among U.S. adults by YouGov, 27 percent of Americans had some savings below $1,000 as of May 2023, while 12 percent said they had no savings at all.

Savings: Quarter of Americans Have Few, One in 10 Have None — https://www.statista.com/chart/20323/americans-lack-savings/

Economy

Scary Charts (WFH edition) 07.02.23

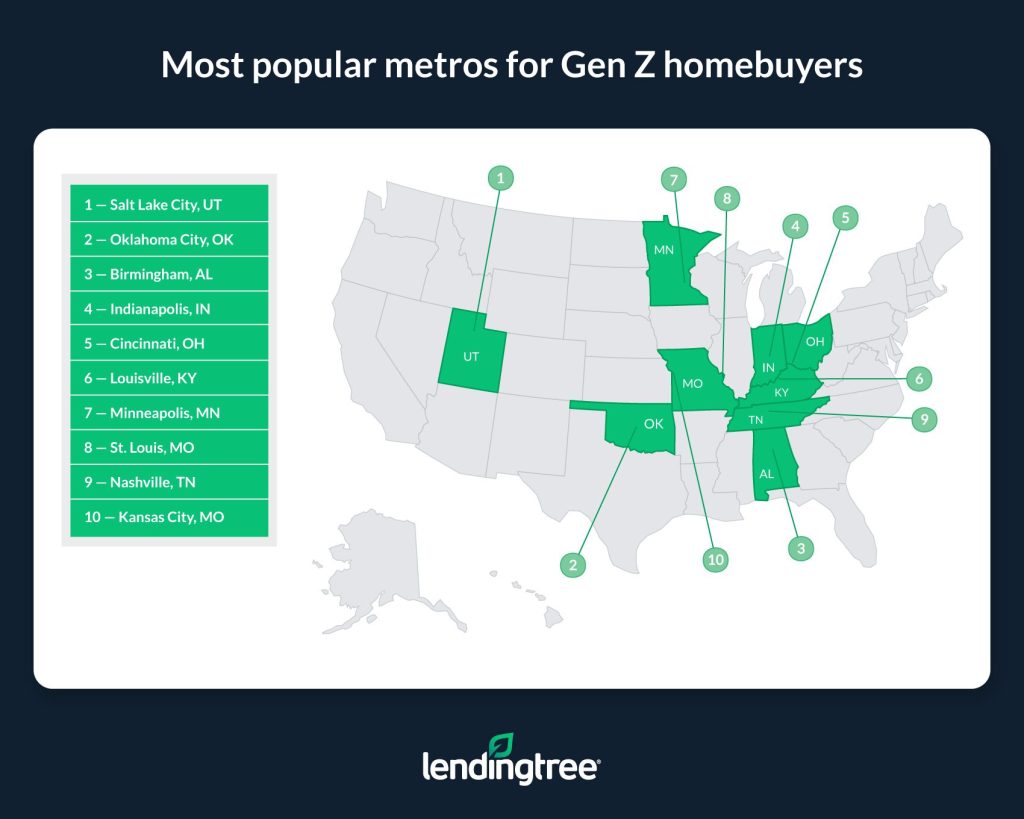

Where Gen Z is Buying Homes

At 22.59%, Salt Lake City has the largest share of mortgage requests from Gen Zers. Though the average mortgage amount in Salt Lake City is higher than in many of the nation’s other large metros, it’s a hot spot for younger homebuyers, likely owing to — among other factors — its strong jobs market and a good blend of urban and rural amenities.

After Salt Lake City, relatively inexpensive Oklahoma City and Birmingham, Ala., are the next most popular metros among Gen Z buyers. Respectively, 22.36% and 20.79% of mortgage requests in these two metros come from Gen Zers.

Most Popular Metros for Gen Z Homebuyers — https://www.lendingtree.com/home/mortgage/the-most-popular-us-cities-for-gen-z-homebuyers-ranked/

Where Are These People Coming From?

Is it the food? We have Chef Andrew Black of Grey Sweater, James Beard Best Chef Southwest – Andrew Black brings Best Chef: Southwest James Beard Award home to Oklahoma City – https://www.oklahoman.com/story/lifestyle/food/2023/06/05/james-beard-award-2023-winners-andrew-black-best-chef-southwest/70289770007/

Could it be the lower cost of living or because Oklahoma is producing 64 times more marijuana than licensed users consume – The Oklahoman

Nah, probably the catfish.

More Random Thoughts on Retirement – June 2023

Another quiet Sunday and I’m thinking about retirement (again). Writers read a lot. I’ll typically have quite a number of books started in various stages of completion. Recently I started reading the first in a series of books titled The Write Quotes: The Writing Life. The quotes paint similarities of thoughts and experiences and are amazing. You realize you are never alone in any of life’s adventures.

Since 2021, more than 1.5 million seniors have reentered the workforce. There were about 10.6 million people ages 65 to 74 employed in 2020, according to 2021 data from the U.S. Labor Department.

That number is expected to increase.

Retiring from retirement: Whether for financial reasons or boredom, a growing number of older adults are rejoining the workforce — https://triblive.com/local/valley-news-dispatch/back-to-work-whether-for-financial-reasons-or-boredom-a-growing-number-of-older-adults-are-rejoining-the-workforce/

Just last month I came to the realization that (I am) Flunking Retirement. When 65 rolled around I started collecting a small corporate defined benefit pension. Years ago the monthly amount had a lot more purchasing power than it does now. Still, I feel fortunate to have this income stream.

In yesteryear, the pension was a staple of the American working class experience—reach retirement age and you could expect to live out your years modestly, yet comfortably, off of monthly payments from your former employer. However, since the 1980s, companies offering pensions are a dwindling breed. Instead, most employers offer defined contribution programs such as 401(k) plans. Only a handful of industries (such as the military, public works and education) still offer pension plans to their retirees.

Why Pensions Are Dying And How You Can Create Your Own —https://www.forbes.com/sites/forbesfinancecouncil/2023/06/05/why-pensions-are-dying-and-how-you-can-create-your-own/?sh=4970c87ec9d4

When I reached my US Social Security FRA (full retirement age) I didn’t retire nor start collecting benefits. Delaying social security payments until age 70 translates into about an 8% increase in benefits annually. If you’re healthy and you don’t need the income for necessities, it’s worth the wait.

Working longer is a powerful lever. Social Security benefits claimed at 70 instead of at 62 are at least 76 percent higher, and the additional years of work allow 401(k) assets to increase and reduce the period of time that the assets need to cover. In fact, my research shows that the vast majority of millennials will be fine if they work to age 70. And although that might sound old, it’s historically normal in another sense: Retiring at 70 leaves the ratio of retirement to working years the same as when Social Security was originally introduced.

Millennials and retirement: How bad is it? — https://www.politico.com/agenda/story/2018/06/07/millennials-preparing-for-retirement-000670/

Millennials are not the only generation ill-prepared for retirement.

America’s 65 million Generation Xers (born between 1965 and 1980) are confronted with a new set of financial challenges that are redefining their plans for retirement, just as they enter their final working years, according to Prudential Financial, Inc.’s latest Pulse research survey, “Gen X: Retirement Revised.”

Generation X confronts harsh new reality of retirement: unreadiness — https://news.prudential.com/generation-x-confronts-harsh-new-reality-retirement-unreadiness.htm

Remember A Plan is Not a Strategy – Update 08.03.22? Having a plan for retirement is great but not all plans turn out as planned. My last executive position ended up being my last executive position and trust me, that was not what I planned. It’s a good thing that my strategy worked a lot better than my plans.

Stay tuned for the next installment of my random thoughts on retirement where I will document (finally) the integrative choices I’ve made that comprise my retirement strategy.

Where Are These People Coming From?

Remember Oklahoma’s ‘brain drain’? Here’s what’s happened since it was declared plugged –Richard Mize The Oklahoman May 11, 2023

- “An influx of Texans and Californians. Texans and Californians moved to the Sooner State at historic rates in 2020 and 2021. Oklahoma saw a net gain of about 8,500 Californians and 7,300 Texans in those years. Other states showing increased interest are Colorado and Arizona.”

- “Growing metro areas. Tulsa is growing fast, but Oklahoma City is one of the fastest-growing large cities in America. Oklahoma City recently climbed past Boston to become the nation’s 20th-largest city by population. In recent decades, OKC has spent millions of dollars to remake the city, adding new parks, a streetcar system, and a brand-new basketball arena.”

- “Diverse and robust city economies. Many parts of Oklahoma rely heavily on the energy industry, but not all. Large areas like Tulsa also specialize in services industries, which have seen the most growth nationwide in the past decade. Tulsa’s economy also specializes in key sectors like transportation and warehousing, information technology, professional and business services, and health care.”

- “Where are new Oklahoma residents coming from? The top states moving to Oklahoma are Texas (17.2%), California (15.6%), and Florida (6.4%).

No link to the full article as it’s behind a paywall.

The next question is why are people moving to Oklahoma?

For the Fried Pies, of course – Arbuckle Mountain Fried Pies named the best snack in Oklahoma https://www.oklahoman.com/story/lifestyle/food/2023/05/23/arbuckle-mountain-fried-pies-oklahoma-food-and-wine-best-snacks-us/70248275007/

Or could it be the cost of housing? Cheap Houses and Awe Inspiring Tornadoes

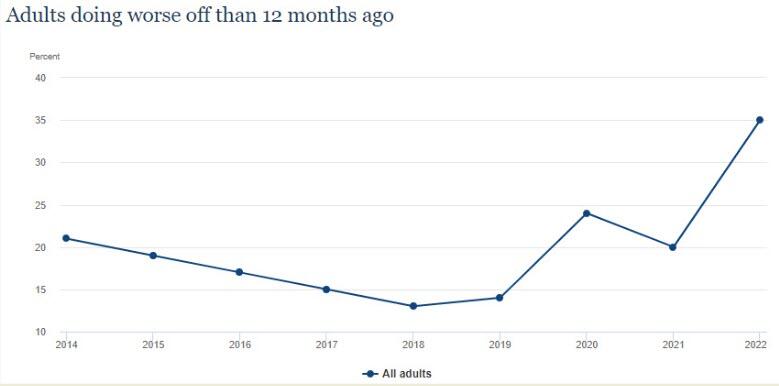

Scary Charts – 06.02.23

via Federal Reserve’s Economic Well-Being of U.S. Households in 2022 report. Source article for the chart and link https://www.zerohedge.com/personal-finance/recession-alert-record-number-americans-worse-financially

Scary Charts – 06.01.23

Source article here https://www.statista.com/chart/19537/single-family-home-prices-in-the-us-by-price-category/

And also from Statista:

We are doomed.

Scary Charts – 04.16.23

Scary Chart or Not?

Kaiser Permanente $4.5B loss in 2022

Nonprofit hospital and health plan operator Kaiser Permanente on Friday posted a $4.5 billion net loss in 2022, compared to a $8.1 billion net gain in 2021, as the integrated system struggled with billions of dollars in investment losses, a rise in care volume and ongoing labor shortages.

Kaiser’s $4.5B loss in 2022 driven by labor expenses, investment losses — https://www.healthcaredive.com/news/kaiser-reports-13b-operating-loss-2022-driven-by-expenses-inflation/642595/

Yikes.

You must be logged in to post a comment.