One BR one bath 384 square feet. Sale pending is contingent so you can still make an offer. Here’s the listing: https://www.realtor.com/realestateandhomes-detail/10036-Carmen-Rd_Cupertino_CA_95014_M19549-12789

real estate bubble

Manhattan’s Trophy Apartments Are Gathering Dust

There just aren’t enough billionaires…

Manhattan’s Trophy Apartments Are Gathering Dust — https://www.curbed.com/2023/11/luxury-central-park-billionaires-row-hudson-yards-weak-sales.html

Scary Charts – 10.22.23

So that drywall mass produced home that sells for $1 million just went up from $4,519 a month to $7,016! That is a 55% increase in less than one-year. So we now have realtors struggling since they make money on high sales volume. You have commercial real estate getting absolutely smashed. Banks are in a tough spots since they made bets on a low interest rate environment. But now, that same home will cost you $2,497 more per month with no measurable increase in underlying value. The house does not have a built in chef, or unlimited childcare, or a Tesla that comes fully charged every day with no cost to you.

The Stalemate of the Century: Housing Facing an Existential Moment — http://www.doctorhousingbubble.com/the-stalemate-of-the-century-housing-facing-an-existential-moment/

Scary charts as promised from the same article:

Oklahoma.

Or California.

Scary Charts (WFH edition) 07.02.23

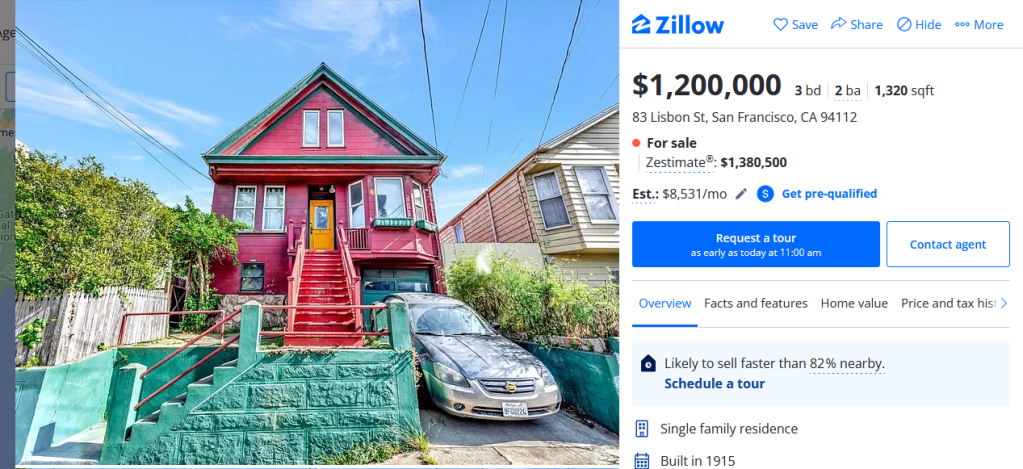

Scary Charts San Francisco Edition – Nov. 2020

There were 2,532 homes listed for sale in San Francisco at the end of October, up 77% from the same week a year ago, according to data from Redfin. About two-thirds were condos. According to data from Compass, inventory of condos for sale was up 85% year-over-year. Inventory of single-family houses was up 25%:

Condo Prices Drop 9% in San Francisco, All-Time Record Inventory Glut Piles Up — https://wolfstreet.com/2020/11/05/condo-prices-drop-9-in-san-francisco-all-time-record-inventory-glut-piles-up/

Meanwhile in Aspen…

In 2019 throughout the entire year, 27 residential properties sold for a price over $10 million. So far this year, a record 48 properties have sold for prices over $10 million, of which 39 have sold since April. This is twice the volume of 2019 and we still have almost four months remaining in the year.At the beginning of 2019, the median price per square foot of a residential property in Aspen was about $1,350. At the end of August, that median square-foot price had risen roughly 15% to about $1,550. In the Snowmass market at the beginning of 2019, the median price per square foot for a residential property was about $680. At the end of August, that median price had risen to about $760, a roughly 12% increase.

Small: The pandemic and rising real estate values locally — https://www.aspendailynews.com/opinion/small-the-pandemic-and-rising-real-estate-values-locally/article_3d9ffcfc-fbaa-11ea-8b7b-379359f41398.html

And since I have your attention down here near the end of the post about that mask debate in Oklahoma…

Tandem Parking Spots Sell for $560,000

Bidding began at $42,000. It shot up to six figures within seconds. When the auction ended 15 minutes later, the lucky winner agreed to pay $560,000 — nearly double the $313,000 median sales price of a single-family home in Massachusetts.

“This is just amazing,” said Ken Tutunjian of Coldwell Banker Residential Brokerage, declaring the price a new parking space high. “God bless America.”

via Tandem parking spots sell for $560,000 – Business – The Boston Globe.

Presented without further comment because you really don’t want to know what I think of this!

Your WTF moment for the day. You have to read the whole post. Priceless.

I often wonder why, when so many TV shows and movies are made here in Hollywood North, more celebrities don’t just buy houses and live here? Say you were a fairly affluent star and had around $3-3.5 million to spend on a place to crash…

View original post 109 more words

The New US Economy

Lost Decade for American Income – WSJ.com

For your Scary Charts check out the article link below.

Or see what Yves Smith is writing about real estate.

You must be logged in to post a comment.