YIKES

Scary Charts

Scary Charts – 09.13.25

Interestingly, older workers (65+) earn around $3,000 more than those in the 25 to 34 bracket, reflecting a group of late-career professionals who continue to command strong wages. Charted: Median U.S. Salaries by Age Group https://www.visualcapitalist.com/charted-median-u-s-salaries-by-age-group/

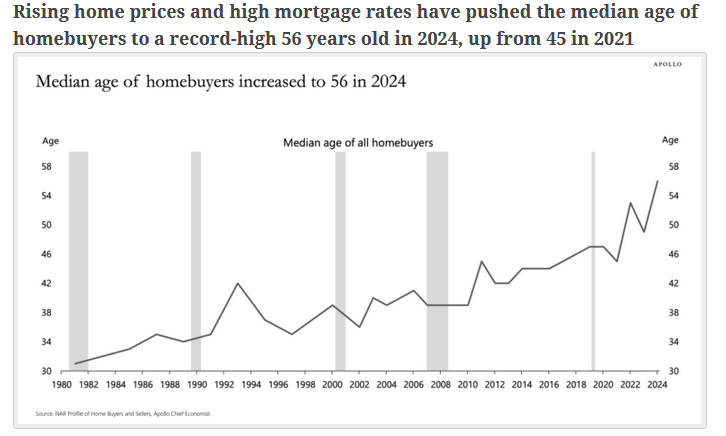

Late-career professional. There seem to be a lot more of us now.

Three in four workers (75 percent) plan to work for pay in retirement, compared with just 29 percent of retirees who report they have actually worked for pay in retirement. In fact, the RCS has consistently found that workers are far more likely to plan to work for pay in retirement than retirees are to have actually done so. 2025 Retirement Confidence Survey – https://www.ebri.org/retirement/retirement-confidence-survey

But if you’re working for pay in retirement how can this be considered retirement?

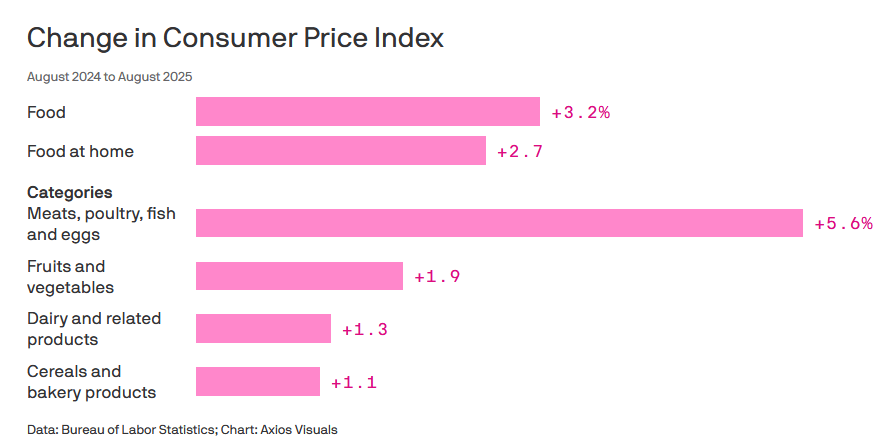

Source: https://www.axios.com/2025/09/11/trump-tariffs-grocery-prices-rise-cpi

FYI, the BLS statistics are BS. Real world eyeball prices at the market tell me so.

Like coffee. Coffee prices in the US has surged more than 20% in the last year.

US coffee prices surge as tariffs take effect – https://www.semafor.com/article/09/12/2025/us-coffee-prices-surge-as-tariffs-take-effect

Ooh…not just coffee.

Here’s the inflation breakdown for August 2025 — in one chart – https://www.cnbc.com/2025/09/11/inflation-breakdown-for-august-2025.html

I guess I’ll keep working in “retirement”.

Scary Charts 06.28.25

(Not) Random Thoughts on Retirement and THE SCARY CHART of the Year So Far

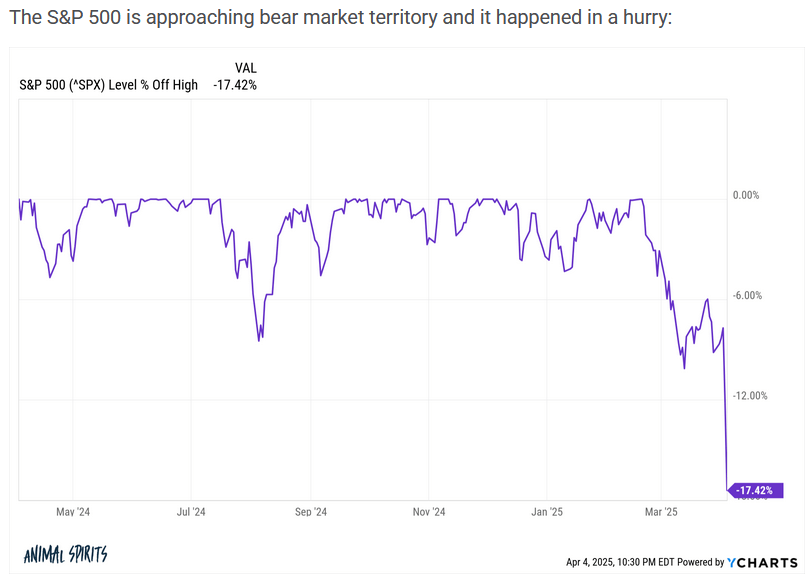

How Bad Could This Get? https://awealthofcommonsense.com/2025/04/how-bad-could-this-get/. I’ve lived through several stock market crashes. And to think I started the day reading up on the latest U of Michigan healthy aging poll.

Working adults age 50 and older commonly reported these reasons for working as being very important:

- Have financial stability (78%)

- Save for retirement (65%)

- Get access to health insurance (59%)

- Support family members financially (52%)

- Maximize Social Security benefits (46%)

Link: https://www.healthyagingpoll.org/

How about adding these bullet points to the list:

- Working past age 50 enables you to weather stock market volatility better

- Working past age 60 enables you to have financial stability when the stock portion of your retirement portfolio loses value

- Working past age 70 enables you to say I’m glad to be still working when the stock portion of my retirement portfolio loses value.

Disclaimer: the additional bullet points are fictional and not related to the real poll questions or answers.

Monday should be a very interesting day in the stock market. Stocks appear to be headed towards a fire sale. Time to buy!

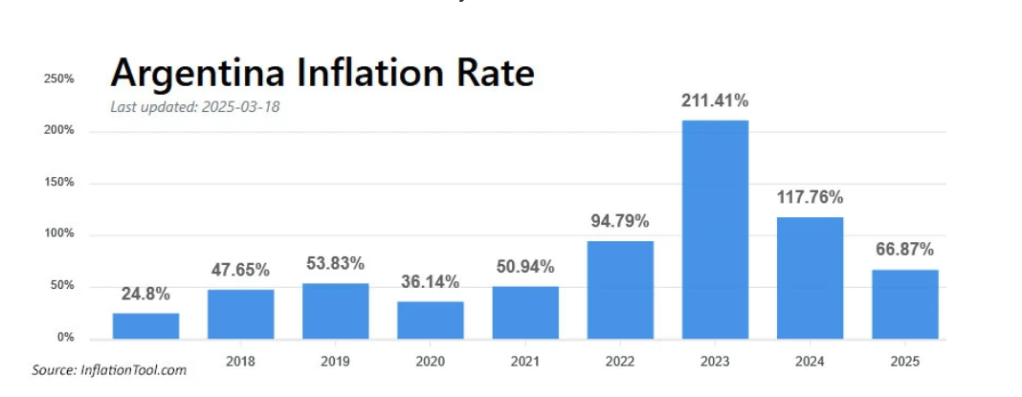

OK, I’ll Stop Complaining About the Price of Eggs (more Scary Charts)

These problems have existed for decades. Rampant government spending and massive government borrowing are two important factors. The government has defaulted on its debt nine times. Argentina’s currency was devalued by 30% in 2015, and then again in 2016. Soon after taking office in December 2023, Milei devalued the peso by more than 50%. https://tipswatch.com/2025/03/23/horror-stories-of-inflation-in-argentina/

Who Holds the Ballooning US Government Debt, even as the Fed and Foreign Holders Unloaded Treasury Securities in Q4? — https://wolfstreet.com/2025/03/18/who-holds-the-ballooning-us-government-debt-even-as-the-fed-and-foreign-holders-unloaded-treasury-securities-in-q4/

Maybe one day I’ll add my personal thoughts when I post stuff but for now I’ll let Scary Charts speak for themselves.

Ah, Houston, we’ve had a problem (Scary Charts 03.10.25)

Source – https://www.apolloacademy.com/there-is-a-significant-need-for-retirement-savings-in-the-us/

Short of forcing people to save for retirement, Social Security remains the safety net for those who lack access to retirement vehicles or don’t have the means to save. – How Many Americans Don’t Save For Retirement? https://awealthofcommonsense.com/2025/03/how-many-americans-dont-save-for-retirement/

TBH, Social Security is a much higher portion of our retirement income than I had planned for.

Scary Charts – 02.23.25

Scary Charts – 12.17.24

Household Debt Ticks Up to $17.94 Trillion

Source: https://www.newyorkfed.org/microeconomics/hhdc

Yikes.

The Dark Side of TikTok – Beef Tallow For Skincare

In just three years, the share of U.S. adults who say they regularly get news from TikTok has more than quadrupled, from 3% in 2020 to 14% in 2023.

More Americans are getting news on TikTok, bucking the trend seen on most other social media sites — https://www.pewresearch.org/short-reads/2023/11/15/more-americans-are-getting-news-on-tiktok-bucking-the-trend-seen-on-most-other-social-media-sites/

Beef tallow (if smeared on your face) may be be comedogenic according to Dr. Lee – The Beef Tallow TikTok Skincare Trend: Here Are The Concerns – https://www.forbes.com/sites/brucelee/2024/12/08/the-beef-tallow-tiktok-skincare-trend-here-are-the-concerns/

This too shall not end well.

The Dark Side of TikTok – Financial Advice?

Scary Charts 12.01.24

Office CMBS Delinquency Rate Spikes to 10.4%, Just Below Worst of Financial Crisis Meltdown. Fastest 2-Year Spike Ever – https://wolfstreet.com/2024/11/30/office-cmbs-delinquency-rate-spikes-to-10-4-just-below-worst-of-financial-crisis-cre-meltdown-fastest-2-year-spike-ever/

Yikes.

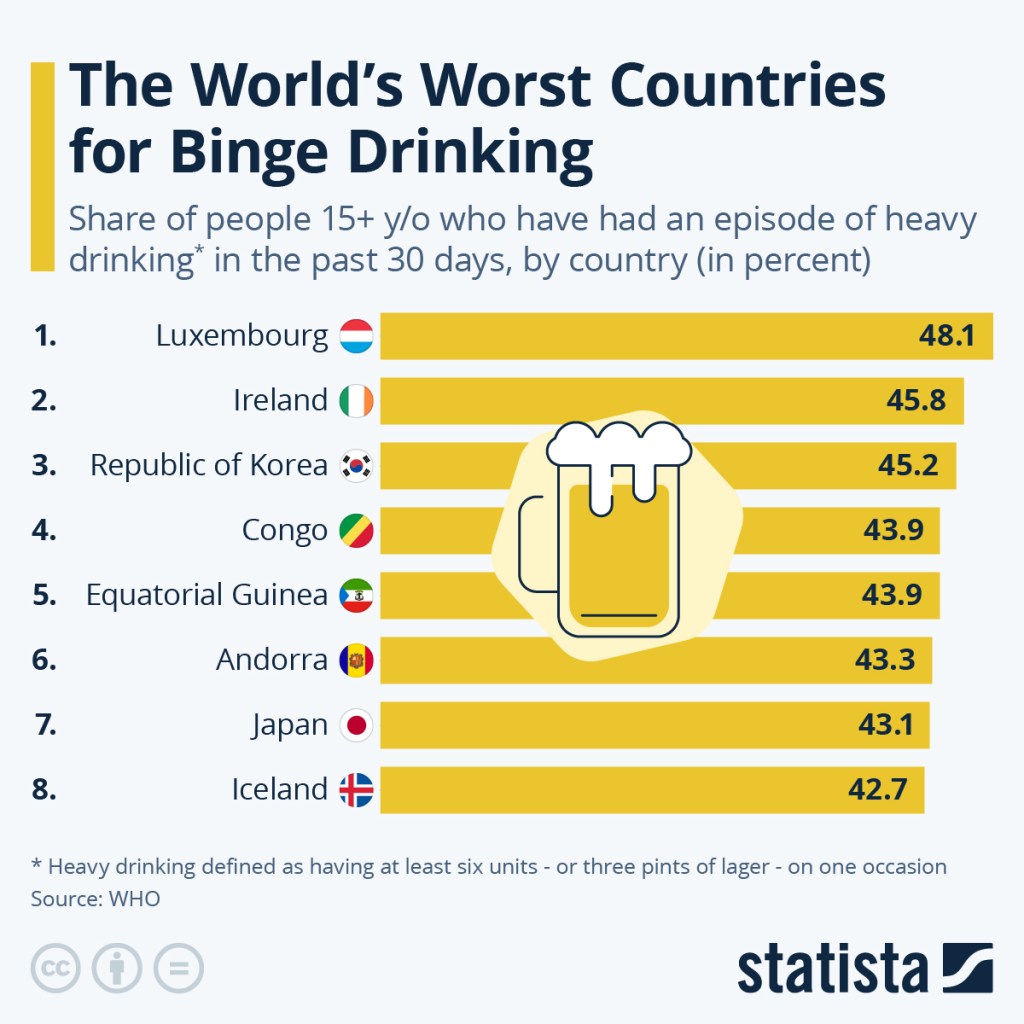

The world’s worst countries for binge-drinking – https://www.statista.com/chart/5357/the-worlds-worst-countries-for-binge-drinking/

Yikes.

Which Lifestyle Changes Can Make You Live Longer? – https://www.statista.com/chart/31766/reduction-in-the-risk-of-premature-death-after-age-40-when-sticking-to-the-lifestyle-factors/

Yikes.

The Worst U.S. States For Binge Drinking – https://www.statista.com/chart/12345/the-worst-us-states-for-binge-drinking/

Yikes. But a great day for Scary Charts!

You must be logged in to post a comment.